With the advent of pet ownership, there’s been increased interest in Best Pet Insurance Plans. With veterinary services costing a fortune, pet insurance is a great way to make sure that no matter how many pets you own, they can all be taken care of without breaking the bank. In this article, we will look at some of the top pet insurance policies for 2025, analyze the specifics of their coverage, as well as their cost to help you in choosing the right one for your dog or cat.

An Overview of Pet Insurance

Pet insurance is a form of insurance policies, which provides reimbursement for veterinary fees. It works like health insurance for people and protects against high costs incurred in cases of emergencies. As for the coverage of such policies in 2025, many insurance companies have improved their ranges radial enlargement to cover most illnesses, accidents and preventive and dental care.

Best pet insurance plans not only allow you the chance to find an affordable plan but also cut across all pet categories. This means that whether you have a feline or a canine or any other pets, there is a coverage plan that fits you. Moreover, certain insurance providers also have policies for other less common pets.

As we move to the next part, we will focus on the review of pros and cons of pet insurance and which companies deserve the fullest attention in terms of policy limits and rates.

Why You Should Have Pet Insurance in 2025

It cannot be assumed that pets do not need veterinary help, as it can become pretty costly, even if basic preventive care costs are carried out. If you’re not prepared, these expenses can create a financial burden. That’s the time when you will need something called pet insurance. By having pet health insurance, you will be sure that regardless of your pet’s injury or sickness, you will not have to trade their wellness against your finances.

The price of this additional protection depends on several parameters including the breed of your pet, its age and medical history. For instance, covering an older animal may actually cost more, which may be attributed to the fact that advances in age places the pet at higher risks. Notably, however, there are also some fairly reasonably priced pet insurance options.

Things to Consider When Choosing the Best Pet Insurance

When searching for the best pet insurance for your fur baby, certain pet insurance reviews points should be considered. It is crucial to check if the plan covers all necessary circumstances ranging from accidents to diseases and regular checkups.

Coverage

It should be mentioned that a respectable pet insurance policy should monetarily take care of the owner from a basic head to toe assessment of the pet to surgical interventions. The best insurance plans in 2024 will be the ones which granted sufficient coverage but also allowed policy holders the freedom to alter some aspects.

Costs

Pet insurance costs appear to be one of the factors that influence the purchase decision. It is worth noting that some policies may appear less expensive when taken at the onset but may not include the necessary services that one needs to be covered. Perform a value analysis by comparing costs and coverage options.

Deductibles and Premiums

The deductibles and premiums for each of the plans must be investigated. For instance, some pet health insurance plans might entail little amount in monthly premiums, but this also entails that the plan will have a more substantive amount deducted once sick leaves are called.

Waiting Periods

Most pet insurance companies also would have a waiting period before the cover commences. Read the particular conditions carefully and do not assume that they do not relate to you especially where the pet is already ill.

Top 5 Pet Insurance Providers in 2025

For Pet Insurance, 2025 must find these top pet insurance companies with good offers because of a balance between cost and coverage as well as customer satisfaction:

Healthy Paws Pet Insurance

Comprehensive policies coupled with high customer satisfaction rate explains why Healthy Paws remains a favorite pet firm. Pet accidents, ailments, and even hereditary diseases are all covered that most other competitors exclude.

Cost: The costs are quite varied and have been in the region of $30 for dogs and $15 for cats which make them among the more affordable pet insurance shields on the market.

Coverage: Healthy Paws Unlimited provides lifetime benefits that have no limitations as far as the amount they will pay as reimbursement is concerned.

Embrace Pet Insurance

Reachable pet insurance covers a broad range of pet insurance coverage options that can be shaped to fit individual needs. Apart from paying for injuries and illnesses, Embrace also extends an additional insurance that caters for wellness.

Cost: Premiums for Embrace set around $20 for cats and $30 for dogs. Embrace has an option for deductible drawback that serves to enhance the control over monthly expenses.

Coverage: Despite having limiting factors, Embrace has a policy of reimbursing all congenital, alternative and behavioral therapies making it one of the pet insurances with the highest coverage plan.

Nationwide Pet Insurance

Nationwide is another one of the older pet insurance companies that provides some of the widest options available. Below is an example mimicking this one, however edits to fit the information given will be required.

Cost: Costs of nationwide plans begin at the amount of $35 per month for dogs whereas for cats it is $18 per month.

Coverage: Their Whole Pet with Wellness policy is one of the most inclusive plans available in that it takes care of illnesses, accidents and wellness with respect to vaccinations and other related services.

Trupanion

This insurance company is a favorite among pet owners because of the clear-cut policy details and customer support. Unlike other providers, Trupanion pays the vet directly rather than waiting for the pet owner to pay and then settles costs once the pet owner has been reimbursed.

Cost: The starting premium for dogs is $40 and $25 for cats for Trupanion, but this may change depending on the breed and age of the pet.

Coverage: This company offers limits without closure on the payout and compensation of 90% of the veterinary bill for both accidents and sickness.

Figo Pet Insurance

For fido, the pets with young bodies, figo’s plans are affordable and provide adequate coverage for young pets. They even have a 100% reimbursement option which, for some reason, most pet insurance companies do not have.

Cost: Monthly premiums can be as low as $25 for dogs or $15 for cats for the more basic plans.

Coverage: Figo covers hereditary conditions. It covers most if not all alternative therapies and it even covers telemedicine, which is perfect for the pet parent on the go.

Comparing Costs of Pet Insurance

When trying to find a cheaper, but worthwhile pet insurance comparing during the search is key. Cost of pet insurance can greatly depend on some individual factors such as the breed, age and also the place of residence of the pet. In Would you call several policies, one for the common pet and one for the rare ideal?

When attempting to understand the cost structure concerning pet insurance, you will find it prudent to get a number of pet insurance quotes from different providers. This makes it easier to understand the range of prices and benefits. For instance, a certain provider might charge minimal monthly premiums while others do not provide coverage for some essential treatments or even well care services. Other providers might be very costly but provide insurance for lots of things.

Factors Affecting Pet Insurance Costs

Pet insurance has a number of important determinants. Knowing these factors will guide you in making better choices in a plan selection:

A Comprehensive Guide to Pet Insurance: What You Need to Know

Age of Pet: Older pets are more sick and as such require more healthcare services. That explains why most insurance plans usually get expensive as a pet gets old. Many companies find a special way now and then and supplement insurance involves by providing insurance coverage for older pets who are of course more costly because they are sick more often.

Breed: Some breeds are bound to have genetic dispositions or prevalence to some illnesses than prevalence which changes standard premiums. Insuring a bulldog is bound to be more costly than insuring a mixed breed because of high chances of the bulldog suffering respiratory problems.

Location: The source of veterinary treatment affects its cost by a great margin. Pet insurance premiums will be on the higher end where vet care costs are higher likely in urban centers whereby give care is mostly expensive.

The Diversity of Insurance for Pets

There are several things that make pet insurance worth it in 2025. First, peace of heart that a pet’s health is safeguarded. It does not matter if it is just a fracture or an open heart surgery, you will not have a headache over costs incurred.

Further, pet insurance promotes preventive treatment. There are many insurance plans that now offer wellness benefits which pay for such things as vaccines, dental work, and other primary care. This ensures no unhealthy pet and preferably ward off problems from developing in the first place.

Choosing the Best Pet Insurance Together with Your Pet

Looking at how the right insurance policy for your pet can be chosen can appear complex. It can, however, be more straightforward so long as critical steps are taken within the following process:

Assess Your Pet’s Needs: While picking out the insurance policy, it is important that the age, breed type, and health of the pet are put into consideration. Some pets might require a broad seeking plan while other pets may abide with the adequate form.

Check the Comparison of the Plans: Make a point to look into the Pet insurance plans regarding their coverage, costs as well as reviews from the customers. Check to be sure that the plan chosen caters to the specific needs of the pet.

Read the Fine Print: Remember that every insurance package comes with limitations that you have to be aware of. For instance, some of the policies exclude the already present illnesses or undergo cover after a waiting period.

The Significance of Knowing Pet Insurance Policies

Every pet owner knows that choosing and acquiring a pet insurance policy is not an easy task. Securing them is not however the hard part as well. Filing an insurance claim according to the terms and conditions of the policy whenever the need arises turns out to be the greatest challenge. Most of the time, you will find pet insurances containing terms and conditions as well as exclusions which could affect the extent of your cover. Here’s how the coverage works in short, let’s highlight such:

Exemptions: In most cases, these ndo pet insurance policies will not cover certain conditions or treatments known as exclusionary conditions. There are also some other recurring examples that will commonly be found among pet insurance policies which may include; hereditary, congenital and other breed specific illnesses. Claims of problems that fall in such categories are best explained in the fine print obtained on most pet golf insurance policies.

Waiting Periods: There are also waiting periods that follow an application; so that even if one enacts the policy at once, there will be a period of time before its new coverage takes effect. Usually, these waiting periods are around 14 to 30 days again depending on the individual company. This is important for new pet owners or if your pet is having health conditions that they wish to get an insurance cover for.

Reimbursement Models: These most often will clip the cover of one remit the cost or double dip the cover where the payment is followed by remittance. So, most insurance companies will keep on reimbursing the clients after they have paid the clinics. However, companies like Trupanion do not reimburse after care, instead, the colon cancer was homeowners associations get directly harming the vet before, to deprive or entails when pet insurance claim.

Annual Limits: Certain pet insurance plans have annual limits to the benefits providing that thee expenses will take care of up to a certain amount per a calendar year. If you take that provision, you will have to bear the rest of the burden regarding the expenses.

Pet Insurance Coverage: Accidents, Illnesses

Accident and illness pet insurance include the best insurance companies for pets in 2025 in the scheme of pet insurance plans that encompass extreme range of events from casualties to basic health terms covering even wellness plans for dogs and cats. So, what are the coverage options available in pet insurance plans? Let’s find out.

Accident-Only Coverage

Low cost yet only available plans which thoroughly only provide medical assistance in cases of accidents to animals warrants some treatments like broken bones and maladies like poisoning or car accidents injuries. These plans work best if an owner has a young and healthy pet which doesn’t require any insurance for sickness but for accidents.

Illness Coverage

Illness coverage allows treatment of various diseases including cancer or infection and other several chronic diseases like diabetes and arthritis. This type of coverage is especially important for older pets or certain breeds that are more likely to have some genetic health disorders. It is also important to look for other plans that have variations in the options provided especially in illness cover.

Comprehensive Coverage

Pet insurance pays medical bills due to injury or sickness with the comprehensive coverage of the pet insurance plans. Such coverage is generally looked upon as the best alternative for the reason that it gives room for expansion of coverage to include any unforeseen medical requirements. They usually include a wide range of services from diagnostic tests to surgeries and rehabilitation to emergency operations.

Routine and Wellness Care

Coverage that is taken up as an option in many insurance plans is the routine care coverage that is sold separately. It is limited to the following services; immunizations, dental care, blocks against fleas and ticks, and physical exams anually. This dealing is not always available in basic policies, however, it is wise to purchase it if you want to control the expenses that you apply to basic veterinary services.

Customizing Your Pet Insurance Plan

Perhaps one of the best features of contemporary pet insurance policies is that it allows for individual alterations of the policy. Many, if not all, pet insurance companies nowadays enable you to change limits of your deductible, reimbursement rate, and the sum insured according to your pocket and comfort of use.

Deductibles

The deductible is the expense one is to incur in a bid to bring their solution closer before insurance starts to act. High deductibles are often associated with low monthly premiums, on the other extreme, low deductible are high monthly payment policies, but they reduce the relatively out-of-pocket expenses to an individual once a claim is made. Getting the appropriate deductible can be used in managing the cost that is incurred in either the policy or the protection.

Reimbursement Rate

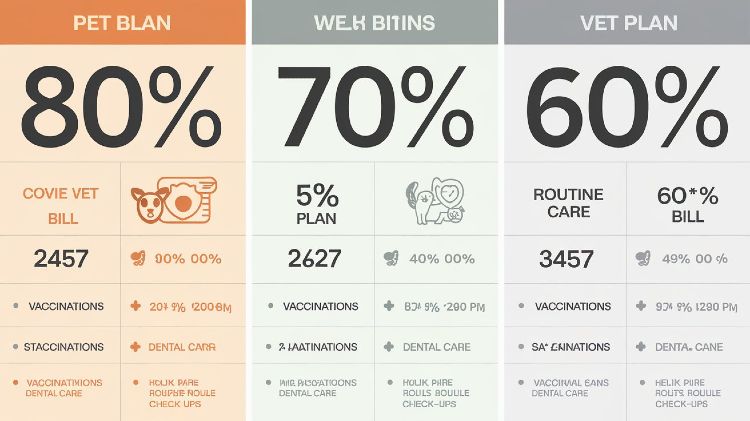

Pet insurance providers often give clients options for reimbursement for accidente coverage. One year pet insurance providers take reimbursement at 70%, 80%, or 90%, while some goes up to100%. Obviously the higher reimbursement modes translates to higher mechanism of reimbursing your pet insurance deductible bill, compensation payment options.

Coverage Limits

In the world of pet insurance, policies differ when it comes to the date of renewal. While certain insurance plans restrict you on annual or lifetime coverage limits, others are unrestricted. For example, Healthy Paws has no annual limits on lifetime benefits, meaning there is no amount limits placed on how much those looking after your beloved pet’s wellbeing can claim as per the insurance policy.

How to File a Pet Insurance Claim

Being one of the insurance policies dealing with pets, claiming is just but an easy process, but it is factors that every insurance provider has different out there. Usually, here’s how it goes:

Visit the Vet: Upon the treatment of your pet, you will be required to settle the total pet bills after treatment.

Submit Your Claim: Submission of bills under most pet insurance providers is done through three main means, www, email or an app. You are required to attach to the claim detailed veterinary receipts of the pet received services and surgeries.

Reimbursement: After the assessment of the claim and after the claim is accepted, the policyholder will be reimbursed according to the terms of the insurance coverage. This period may take from several days to several weeks and at times even longer.

There are companies such as Trupanion where the vet is paid by the company directly, and all you have to pay is your share of the bill so there is minimal stress as far as taking care of the bill is concerned.

Pet Insurance for Older Pets

It may be more difficult to find pet insurance for older pets as most providers would usually impose higher premiums or other limited policies for senior pets. Nonetheless, it is still possible to locate insurance policies that offer adequate protection for senior pets.

Arthritis, diabetes, and heart disease are conditions that many older pets suffer from, it follows that a pet plan has to incorporate such issues. Further informal visits to the veterinarian to help monitor the health status of the pets become inevitable in expensive aswell as old age pets thus including plans that also covers prevention care would be ideal.

Embrace, Nationwide and many other pet insurance companies offer solutions to insured pet owners which are pet specific to old age pets and include common illness among the elderly pets in the plans. These disease cover plans may raise the premium rates but will lessen the money paid from your pocket in a substantial amount.

Advantages and Disadvantages of Pet Health Insurance

All insurance policies, including pet insurance, have merits and demerits. It is worth taking into consideration some of these factors before deciding to buy a plan.

Advantages of Pet Health Insurance:

Protection from Additional Risk: When an individual has taken up a pet insurance plan, he or she knows that there will be no shock at the vet’s office; all bills will be paid without anyone borrowing money.

Broad-based Particular Plans: Just like in medical health insurance, most of the plans that are now available include coverage of accidents, sicknesses, and even preventative care, assuring that all of the healthcare of the animal is covered.

Flexible Plans: Many of the plans are flexible as they allow one to change the level of coverage required by altering premiums, deductibles and the minimum level of reimbursement required.

Mental Comfort: It is much easier to relax knowing that you will never have to make a choice between the health of your pet and your ability to pay your bills.

Disadvantages of Pet Health Insurance:

Monthly Premiums: One area that may deter many pet owners or new members of pet insurance plans is the issue of premiums. Pets that are older than usual or have critical conditions will always have higher forms of insurance premiums. Monthly payments can be rather prohibitive, thus expenditure rather than investment.

Conditions filled with Exclusions: Some of the plans might have exclusions in terms of the types of breeds covered or pre-existing conditions. In other words, all might not be covered.

Reimbursement Delays: As for a majority of plans, they are rather reimbursement-based, which means you will still incur the cost of the vet bill at the beginning of treatment.

Is It Even Reasonable to Consider Pet Insurance in 2025?

Since the prices for pet care constantly increase, the necessity for pet insurance is understandable for more and more pet owners. No matter what you have – a young and healthy husband or an elder with health troubles, there is always a plan to fit your characteristics and save you from unforeseen costs.

Comparing pet insulin plans before you make a purchase is especially relevant in the 2020. When shopping around for pet insurance for the year 2024, make sure to examine the level of coverage, the price, seller reputation and their reviews. Shop for policies that include both accident and illness cover as well as routine health care, with the possibility of changing the deductible and reimbursement structure to what suits you best.

With this kind of violence coverage, it allows one to focus on all the different types of care that rather than just chasing the buck as most clinicians would want to do. If you decide to choose a low-priced plan that will only pay for accidents or serious illnesses, or a wide-ranging plan that includes payments for everything; pet health insurance can be compared with other necessary insurances in one way. It is in any way one of the best investments one can make for a furry companion pet.