Introduction: Health Insurance Waiver Form San Jose

A Health Insurance Waiver Form in San Jose relieves you from carrying the institution’s insurance if there is an existing one. Because of this form, ‘students’ and employees’ with other comprehensive plans are able to avoid this disproportionate allocation of resources. To avoid duplication of medical coverage, it is possible to submit a waiver so that one maintains only that healthcare coverage most appropriate to them. It is important to note that as much as this is the case, there are processes of filling waivers and deadlines which have to be adhered to if one is considering the best option for them with regard to health care.

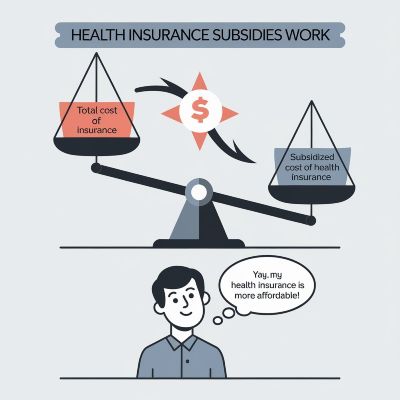

What is a Health Insurance Waiver Form?

A health insurance waiver form serves as an opt out form when an individual does not wish to participate in a particular provided insurance plan. Institutions such as colleges and workplaces often these days provide insurance as part of a student’s or an employee’s package that some people may not wish to utilize. In case you possess sufficient coverage from some other source i.e. a parent’s insurance, a spouse’s employer or your existing policy then a waiver form helps in relieving paying for unnecessary insurance.

These forms are most important as they help to avoid unnecessary costs which may end up in getting two insurances. They have to show proof of such coverage if they want to opt out, which means that those opting out will still have basic health insurance. It is very important to know these forms as they will help in making choices pertaining to healthcare.

Why Opt for a Health Insurance Waiver?

There are considerable savings to be made when health Insurance waivers are opted for. Unnecessary coverage should be tilted in many instances doing so simply equates to cutting costs to the extreme. A majority of the organizations display insurance policies with fees included in the expenditure and worst of it, if one does not use the cover they will still lose their money.

For students, particularly university students with waiver forms applying, they would rather use their health canvas to alleviate values that are not there. A huge percentage of most students are already on family cover making those students insure again irrelevant. Employers also have their templates other than for employees, and these are called waiver policies where employees with existing cover do not have to pay for coverage from the employer.

The Relevance of Waiver Forms in San Jose

The progressive and growth oriented region of San Jose is composed of various educational institutions and numerous companies. For the citizens, particularly students and workers, seeking health insurance is part and parcel. Grasping the waiver forms enables one to undertake this task with more ease.

Waiver forms are now a common phenomenon in administrative processes in San Jose which has many immigrants in addition to all the educational institutions. When either going to campus or getting into a new work environment, learning about these can help you avoid cumbersome health insurance options.

How to Obtain a Waiver Form in San Jose

In San Jose, it is easy to get a health insurance waiver form. Let’s start with the organization or employer who is responsible for the insurance. Most institutions and their universities maintain a health service or an administrative Office that holds fret Diagrams from any purchase.

About the same time, the workplace usually supplies these through HR. For discrete institutions, the internet facilities as the portals provide forms that can be downloaded readily for the citizens to fill at their appropriate time.

Filling Out the Waiver Form Correctly

The accuracy in filling the waiver forms cannot be overstated. Mistakes can result in the denial of waivers and even incurring needless coverage. Therefore, make sure that you have everything required, especially if you have an existing insurance policy.

Most forms can ask for verification of comparable coverage. This means that you will have to provide some information from your current insurer. Be sure to check if there are other forms or additional documents required that are peculiar to your institution or employer.

Common Mistakes to Avoid

By avoiding common mistakes, the waiver procedure can become easier. One of the common errors is failing to establish reasonable proof of insurance cover. For active insurance policy holders, make sure that the documents submitted are up-to-date and comprehensive regarding the coverage.

Another regular fault of everyone is the absence of submission within the time limits. Most of the institutions and/more employers based have time limits regarding waiver submission as these times are highly regarded during the onset of any academic year and/or working period. Go with these dates and provide well in advance so as not to have any problems.

The Importance of Deadlines

When it comes to the waiver form, it is essential that the submission deadlines are respected. Forgetting to submit on time may lead to automatic registration into the insurance program followed by unnecessary payments. Check your email or notifications that your institution or employer may send out for the deadlines.

Management of time can really help you avoid the last minute rush. Make sure that you have all the papers required and the application filled up earlier on, so that you do not spend extra time or tackle even more challenges later than expected.

What Happens After Submission?

The review process of the waiver filled in by you commences once it has been submitted. Usually, the institution or employer will consider the information supplied and will examine whether your current coverage is adequate.

Approaching the process, you will get a confirmation saying, “The application is still approved”, also, it summons that this is very important documentation for your safety. This is done in case efforts are made to dissolve, reconsider, or subject them to notifications training.

Addressing Denials and Appeals

If your waiver form (or request for waiver) gets refused, it is advisable not to panic. Usually such refusals are due to lack of particulars or inadequate proof of coverage submitted. Most institutions and employers accept appeals.

It is necessary to read the reasons for the denial carefully and comprehend them. Some reasons may call for submission of further information and then a re-application. Patience and accurate timing of actions are the most important factors for overturning a denial.

How Waiver Forms Benefit Employers

As far as employers are concerned, proper completion and control of health insurance waiver forms helps in optimal allocation of resources. Companies are able to minimize costs on insurance by permitting certain employees with existing coverage to opt out.

By allowing waivers, employers are also contributing to increasing employee satisfaction. Employees on the other hand, do not want to be forced into unnecessary covering and that takes care of their needs and personal situations which results in higher general satisfaction at the workplace.

How San Jose Institutions Handle Waiver Forms

Colleges in San Jose have simplified procedures for submission of waiver forms. Colleges often have such offices which assist the students. There are facilities and information provided in these offices for assistance in the waiver process.

Employers tend to have HR which takes care of the waivers. They provide assistance such that the employees are aware of the benefits and processes helping in having such in place without interruptions.

FAQs: Health Insurance Waiver Form San Jose

What is a Health Insurance Waiver Form?

A Health Insurance Waiver Form’s purpose is to help individuals remain without enrolling in any health insurance scheme if they have enough cover which usually happens when people have alternative health insurance covering like that offered through their spouse, parents or other insurance providers.

Who is eligible to submit a Health Insurance Waiver Form in San Jose?

This requirement is specific to the particular institution or employer but, generally, most of the people who would provide a waiver are those who can demonstrate that they have commensurate or better health protection cover than that offered by the particular institution.

What types of health coverage qualify for a waiver?

Qualifying coverage generally includes employer-sponsored plans, Medicare, Medicaid, coverage by one’s spouse, domestic partner and even parent. Specifics may however vary by the organization seeking the waiver.

How do I submit a Health Insurance Waiver Form in San Jose?

However, there are differences in the manner of submission. For the most part, it is possible to complete the waiver form on the employer’s or institution’s website which is typical of most people. Some may require a paper form submission.

What do I need to submit in order to get a waiver?

You might have to submit some insurance plan insight letting the body know of the coverage’s policy number, its provider, etc. Some institutions may also need certain forms or documents from the insurer.

Conclusion: Health Insurance Waiver Form San Jose

On the other hand, once you get the right documents there are ways to complete health insurance health waiver forms in San Jose without breaking a sweat. If I had the correct information and I was proactive I would make decisions that would not hurt my pocket or my health. This is particularly important whether you are a student or working since this helps such individuals to appreciate the importance of these forms in making choices about their health cover plans.

For people who want to find out more regarding health insurance alternatives and waivers, institutional health offices or HR departments are where to go. They are good sources in helping in making the best choices regarding the situation at hand.