Introduction: Strategic Limited Partners Health Insurance

Strategic Limited Partners offers specialized, all-encompassing health insurance products specifically crafted to be relevant for the wide range of limited partners and their investments. The health insurance solution has been constructed with a view to long-term security and reliability; this implies they supply something from easy medical cover throughout so much to tremendous refined wellness schemes, that means limited partners can stay protected of their well being on the equivalent time all through key strategic objectives. Strategic Limited Partners Health Insurance helps partners protect their health and stay resilient in today’s fast-paced investment landscape by providing access to quality healthcare providers, risk management resources, and flexible coverage options.

Understanding Strategic Limited Partners Health Insurance

SLPs are those investors who not just bring capital but something more by way of experience, network or stature in a sector. SLPs in the Health Insurance striatum might include provider organizations or non-traditional health plans who have penetrated that part of insurance space. Such partners are typically valued for the insightful advice and strategic gains they provide, rather than simply their monetary support.

SLPs in health insurance businesses enable innovation around products and services that are more relevant to consumers. This is especially crucial in an environment subject to rapid changes in consumer needs on account of technological advances and regulatory movements. SLPs can offer actionable intelligence into these changes, enabling insurance businesses to change their direction and be more fluid.

In addition, SLPs frequently serve as collaborators and partners with other essential stakeholders in the healthcare sphere. This can also lead to synergies which enrich service offerings and improve customer satisfaction. So, in very basic terms let’s say an SLP has good relations with one of the leading telemedicine provider and if he brings it on board for providing online healthcare services to a tier 1 insurance company then there lies his benefit that will help him label himself as part market leaders cum digital healers.

The Role of SLPs in Health Insurance

Health and Auto both have business to consumer experience yet are different because the SLPs in health add capital, but also strategic perspective that sets tone for venture. They bring with them not just new insurance models but also better risk management strategies and customer experience initiatives. SLPs are able to provide insurance firms the insight and contacts necessary to recognize new trends, capitalize on new business opportunities.

Reducing Risk – Probably the most important value an SLP can provide is being able to identify and mitigate potential risks. A valuable component of this is the health insurance industry, which has faced issues such as regulation changes and market volatility. In their industry-knowledge capacity, SLPs assist insurance companies with the development of sound risk management systems to safeguard against uncertainty.

Second, SLPs often step in with years of experience dealing with complex regulatory landscapes. This can be a real boon for insurers seeking to expand into new markets or develop innovative products that need regulatory approval. Through the stormy seas of regulation: Navigate firms through perennially changing regulations to shorten your time-to-market and make sure to comply with industry standards.

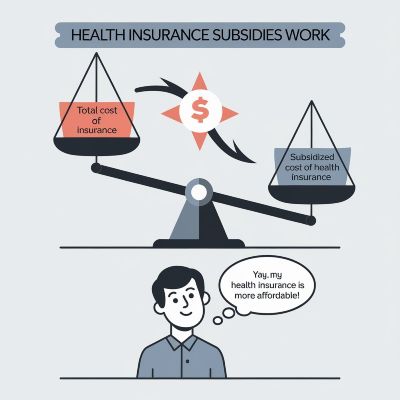

Benefits: Strategic Limited Partners Health Insurance

There are several benefits for health insurance companies to engage with strategic limited partners. To begin with, being able to talk things over with an expert can greatly improve the firm’s decision making process. SLPs have so much to offer, and there are many ways we can use our knowledge and experience to build creative strategies.

Second, strategic partnerships can be used to save money by improving efficiency and reducing duplication. An SLP who works with InsurTech could provide consultation to an insurance company and how they can streamline their systems, benefiting from state-of-the-art technology deployment in the process where costs are expected to fall by half as well.

Strategic partnerships boost brand reputation and credibility. Investing in reputable SLPs allows insurance companies to improve their market position and attract more consumers. This is especially helpful for competitive industries where trust and reliability are primary differentiators.

Case Study: Strategic Limited Partners Health Insurance

Like a large technology firm teaming up with a provider of health insurance. This collaboration empowered the insurance company to benefit from deep insights using data and machine learning capabilities of a technology firm, which ultimately resulted in personalized health profiles and their respective product offerings.

With the help of big data, the insurer was empowered to provide customization in coverage options — which had an immediate impact on customer satisfaction and claims costs. As such, this partnership widely represents how strategic LPs can create value and resonate as a go to market in the health insurance space.

The deal was also a catalyst for the insurance firm to begin incorporating more sophisticated digital tools including mobile apps and online portals, thanks in part to involvement from technology companies. This improved the customer experience all around, giving customers quick and easy access to their insurance information and tools.

Strategy Development and Implementation

Strategic partnerships implementation: how to do it well It starts by finding the perfect partner that agrees with the vision and mission of your firm. Such as evaluating target partners according to what skills they can bring, or whether their historical performance aligns with the firm’s values.

This phase, which follows the search for an appropriate partner is enabling defining project scope and objectives of the partnership. This could be defining what success looks like and putting KPIs in place to measure performance. Alignment will require interfacing with other entities or people quite regularly, so approaches to managing these relationships are key.

It is also important to always oversee progress of the partnership and evaluate its path. It allows us to make the relevant and ongoing adjustments or improvements we need at that time ensuring our partnerships stay of value.

Challenges and Considerations

Although strategic partnerships do provide a long list of rewards, they also present their own set of challenges. A common difficulty in this regard is the possibility of divergence between goals and priorities between the partnering entities. This can stall the progress of your partnership as disagreements erupt and swirl across.

In order to avoid this, have transparent lines of communication and make it a habit always be honest. Meetings should be scheduled and decision-making processes can work together to establish shared goals so everything is aiming towards common outcomes.

There is also information asymmetry to consider (one party knows more or has expertise in an area where another person does not, and therefore cannot make the same [informed] choices). It clearly leads to a power imbalance in your relationship and affects how you can handle the business. To counter that, knowledge sharing and capacity building mechanisms need to be in place for both parties based on the resources available.

The Future of Strategic Limited Partners in Health Insurance

As the health insurance industry continues to refine itself, strategic limited partners are likely going to play an even bigger role in this sector. As healthcare systems become more complex and digital health solutions proliferate, SLPs are a crucial part of the future of insurance innovation.

Over the next few years it is likely we will see insurance firms partnering with SLPs from different industries – technology, pharma and finance. This collaboration will permit insurance companies to make use of the talent, competences and resources which are with their SLP partners therefore progressively more competitive.

In addition, with the constantly increasing level of customer expectation being experienced across all sectors insurance companies will be required to move toward an exponentially more consumer-centric and individualized encounter. Understanding the role of SLPs in meeting these demands will be crucial to both answering the call from regulators and delivering value for policyholders.

FAQs: Strategic Limited Partners Health Insurance

How Is Strategic Limited Partners Health Insurance Different From Traditional Health Plans

Strategic Limited Partners Health Insurance is a coverage specialized for limited partners with limits dedicated to the health risks which are typical of investment activities and business ventures.

Which health coverage is covered in this plan?

The plan can include everything from routine checkups to 24/7 care, mental health support and targeted well-being programs that collectively optimize the physical and emotional wellness of limited partners.

Is Strategic Limited Partners Health Insurance customizable?

Yes, these plans are very flexible with customization offering for LPs to select coverage based on their individual health concerns and commitments.

Does this health insurance offer any assistance in wellness programs?

Long-term healthcare Limited partners can access insurance that comes with wellness programs like health screenings, fitness incentives and lifestyle coaching to keep them in their best shape for as long as possible mitigating potential future risks.

Learn more about whether the Plan uses a Network of docs

By Strategic Limited Partners health insurance partners typically get the broadest network of providers available (no matter where they are in the world) and benefit from a greater level of choice over which provider is best suited to their individual needs.

Conclusion: Strategic Limited Partners Health Insurance

The health insurance space has been conservative towards strategic limited partners, but we believe they can collectively provide resources that drive innovation and impart competitive edge. Insurtechs can open up new possibilities, optimizing their operations and enhancing the experience they deliver to customers by franchising partnerships with SLPs.

Organizations must plan effectively, communicate efficiently and evaluate continuously, as this is how to deliver the perfect partnership. That is, the insurance company can both address challenges and develop strong relationships that will enable them to reap those strategic limited partnership benefits which no doubt they need even more so in an industry where change seems like a foregone conclusion.

Read the rest of our resources and case studies to see how strategic limited partners can grow your health insurance business. Drive home the strategies of partnership and occupancy amidst an ever-changing health insurance scenario.