The journey of starting a new business is an exciting yet challenging one, and the right business insurance is among the key elements that make sure your startup remains successful in the long term. Customized business insurance quotes for startups can give you coverage options that suit your personal requirements thus protecting your start-up from unforeseen risks. In this comprehensive guide, we will look at the significance of customized insurance, how to get tailor made quotes and advantages as well as disadvantages of different types of insurance policies. Additionally, there will be an FAQ segment with detailed answers to common questions.

Why Customized Business Insurance Is Necessary

In setting up a start-up company, there are various risks like property destruction or legal liabilities that may be encountered. This means that customized business insurances are crucial since they offer personalized protection that suits individual hazards and needs of startup businesses. Unlike general policies, customization ensures you do not pay extra for coverage not required but still protect vital areas also left out.

Why Startups Need Customized Business Insurance

- Risk Assessment: That a start-up faces different risks according to the industry it is in, its size as well as business model. Each contingency can be taken into account through specific quotes.

- Budget Management: The focus of insurance aimed at start-ups is on avoiding unnecessary generic expenses through appropriate coverage that helps companies make effective use of funds.

- Compliance: However, each state has different legal requirements and various industries have their own. In this case, individualized insurance ensures compliance with all rules held by each country or industry.

How to Obtain Personalized Business Insurance Quotes

The following processes will lead you to custom-made business insurance quotes:

- Assess Your Business Needs: At the beginning determine risks related closely with your startup, varying from property risks, liability issues to employee dangers.

- Find out Providers: Compare services, coverage options, and customer reviews about potential insurers offering customized business insurance quotations.

- Ask for Quotations: Contact insurance firms requesting for quotes. Don’t forget that you have to give them information about your operations as well as financial situation plus hazards.

- Compare Quotes: Review the quotes you have received, with particular attention to coverage, exclusions and premiums. Check if such policies are fit for your company needs.

- Consult an Insurance Broker: It is worth considering assistance from an insurance broker who can help you navigate through the complexities of business insurance and find the most appropriate customized quotations.

Customized business insurance for a start-up is necessary when it comes to industry-specific risks. For instance, if you are starting a landscaping firm, landscaping business insurance should be considered. Some of these issues include liability for on-site accidents and equipment damage.

Landscaping business insurance allows your business to be safeguarded from such specific risks. This ensures that the policy has addressed various matters like general liability property insurance and worker’s compensation as needed thus giving room for growth in a well-secured manner avoiding unforeseen events. An appropriate coverage should be in place whether your startup deals with landscaping or other sectors so as to ensure success over a long period of time.

Types of Personalized Business Insurance

Here’s a summary of different insurances that can be customized to meet needs of startups:

1. General Liability Insurance

This type of start-up insurance should be tailored to match its specific mode of operation. This is important because it provides the best protection against third party claims relating to bodily injury, property damage or advertising injuries.

2. Property Insurance

Customizable premises coverage might include protection for specialized machinery or stock exclusive to your startup. Such as fire, theft or vandalism destructions on your business belongings.

3. Professional Liability Insurance

This coverage is also known as professional liability insurance or errors and omissions insurance. It shields people from being sued for professional negligence or mistakes in their professions. If your start-up falls under areas such as consulting or IT services, personalizing your coverage ensures that you have enough protection.

4. Workers’ Compensation Insurance

Most states require workers’ compensation which offers benefits to workers who are injured on the job or who become sick due to work-related hazards. You can tailor your workers’ compensation to fit within your industry, as well as fragmented roles within workforce.

5. Business Interruption Insurance

Should a covered event occur rendering your company temporarily unable to continue operations, business interruption coverage will provide for lost earnings and normal operating costs. Customizing this form of insurance means that the business will get exactly what it needs based on the specific risks that may be faced by any given start-up.

General Liability Insurance helps protect small businesses from claims arising from their activities that cause bodily injury or property damage. It takes care of legal expenses and compensation costs arising where a customer or member of the public gets injured or his property is damaged as a result of your business operations. In case you wouldn’t have had so much monetary capital available for its coverage, this insurance is going to reduce risks and give you confidence in focusing on expanding your business without facing any risk of expensive court cases.

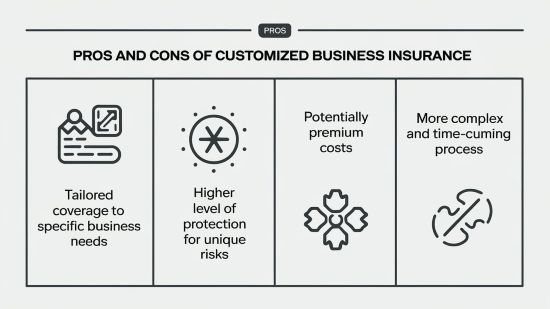

Table: Pros and Cons of Customized Business Insurance

[wptb id=454]

FAQs on Customized Business Insurance for Startups

What is customized business insurance?

Customized business insurance is insurance coverage that has been developed specifically to fulfill the unique requirements and risks of your startup. It offers a custom-made system of security in comparison with regular policies depending on the industry, size and peculiarities of business.

How do I know the right amount of coverage for my startup?

Do a risk assessment for your enterprise to help you know how much cover you need. Determine risks and their financial implications; then seek advice from an insurance broker on how to get appropriate protection at reasonable prices.

Can I change my business insurance policy as my startup grows?

Since businesses are not static entities but dynamic systems, there should be different approaches towards them especially when handling new projects or startups. Just like companies advance so do their exposures and associated insurances. It should be regularly reviewed to ensure it remains fit-for-purpose, making necessary changes when required.

What are the ways to get cheap personalized commercial coverage?

In order to save money, you should:

- Combine different kinds of insurance in order to save.

- Raise deductibles so that your premiums will be reduced.

- Through risk management practices, reduce the probability of claims occurring.

- Periodically review and compare several quotes from various insurance providers.

What should I expect from an insurer for a start-up?

When selecting an insurer, keep in mind the following:

- Status of the provider and its financial stability.

- Variety of coverages available and possibility for customization.

- Quality of customer service plus claim settlement procedure

- Opinions formed by other entrepreneurs within your industry.

Conclusion

Customized business insurance quotes are necessary for ensuring that a startup has adequate coverage for its specific needs and risks. Preventing possible failures in the future can be achieved if you understand what each type of insurance is all about, follow the steps to get personalized quotes and constantly review your policies.

The time spent on obtaining and evaluating individualized insurance quotes will result in tailored coverage, as well as peace of mind that allows you to focus on growing your business. Make use of experienced insurers and intermediaries that would guide you throughout this process so that you receive perfect startup protection plans.

I’ll be here if there are additional questions, or if you’d like to start getting your own customized business insurance quotes today!