A right auto policy for an automobile is a must to have for a young driver. For new drivers, finding the best policy can be overwhelming given the variety of choices and unique challenges they encounter. This guide will help you navigate the world of car insurance for new drivers and provide insights into the Best Auto Insurance For Young Drivers, money-saving tips as well as practical advice to make sure you choose wisely.

Why Auto Insurance Matters for Young Drivers

Getting behind the wheel is an exciting milestone in a young person’s life; however, it entails responsibilities such as obtaining adequate auto insurance. Proper car insurance for young drivers is not only essential in ensuring legal compliance but also in giving financial cover in case accidents or damages happen. Young drivers are usually charged higher premiums due to their being inexperienced hence it is important to know what makes up the best car insurance for young drivers that balances cost with coverage needed.

Factors Influencing Insurance Premiums for Young Drivers

A range of factors impede on how much you have to pay for car insurance for young drivers. Understanding these factors can help one in making informed decisions that could possibly reduce their insurance costs.

1. Driving Experience

One of the primary reasons for premium differences is lack of driving experience. As statistical data shows, new vehicle owners are more accident prone leading to increased premiums by insurers. In order to mitigate this risk, young drivers should complete driver education courses and gain more practical experience by driving themselves.

2. Type of Vehicle

The type of automobile that you own has a huge bearing on the cost of insurance. Normally, top-end cars such as sports cars and luxury vehicles attract higher premiums because they require expensive repairs or replacements. Conversely, going for an affordable reliable car could also curtail your premiums.

3. Location

Place of residence has significant impact on individual’s auto insurance payments. Urban areas with high traffic and rates of crime always attract higher premiums while rural regions with less traffic but fewer accidents normally offer cheaper prices.

4. Driving Record

Keeping insurance costs low requires a clean driving record. Insurance carriers will offer reduced premiums to drivers without accidents or traffic offenses while drivers with collision records and speeding tickets pay higher rates.

5. Coverage Levels

The kind and amount of coverage you purchase will have an impact on your insurance premium. Legal obligations may require liability, but comprehensive and collision policies are more expensive. To find cheaper insurance, it is important to balance your desired levels of coverage against both your necessities and financial ability.

Best Auto Insurance Options for Young Drivers

Comparing different providers and their offerings helps in finding the best insurance for young drivers. Here are brief overviews of some leading insurance options.

State Farm

Their extensive network combined with competitive prices makes State Farm one of the most preferred choices among young drivers. Discounts available for younger drivers include good student discount and safe driving discounts among others.

Pros:

- Discounts are available for good grades and safe driving.

- The company has a vast network of local agents to ensure that you get personalized services.

- It is known for its high levels of customer service and support.

Cons:

- May be more costly for motorists with higher risk profiles.

- Rates can differ depending on locality and driving pasts.

Geico

Geico is widely regarded as being cheap and having easy-to-use digital tools. It enables young drivers to handle their policies quickly online, including receiving discounts like those offered on behalf of good students who have limited mileage coverage rates available at all times directly through the insurer’s stand-alone website or applicable mobile applications they offer to their customers via various means from smartphones/tablets (eg iphone, blackberry etc).

Pros:

- They have competitive prices along with multiple discount options.

- Easy-to-use online tools and mobile app for managing your policy.

- Good customer service with a focus on efficiency.

Cons:

- Limited options for in-person support and customer service.

- Some users report variability in coverage options depending on location.

Progressive

Progressive offers innovative programs like the Snapshot program which tailors rates based on individual driving habits. This can be especially beneficial for young drivers who practice safe driving.

Pros:

- Snapshot program means that discounts will vary based on driver behavior

- It has several covers available with a number of additional value added services

- Is fit for people who are at greater risk since it allows them different possibilities.

Cons:

- Location and driving record could make premium rates to fluctuate

- Some people may see the Snapshot program as being intrusive.

Allstate

Allstate is a company that offers discounts and has good coverage. They have programs in place which are designed to aid young drivers in improving their driving skills with the aim of lowering their premiums.

Pros:

- Numerous discount opportunities, including safe driving and bundling discounts.

- Various options for extensive protection with different add-ons.

- Safe driving programs and access to informative resources.

Cons:

- Premiums of competitors might be higher in some areas.

- Customer service experience can vary depending on the location.

Liberty Mutual

Liberty Mutual is one of the leading companies for young drivers who want cheap rates as well as tailored coverage options. Additionally, they offer ways to bundle policies, which may reduce insurance costs generally.

Pros:

- Auto and home insurance bundles come with discounted prices.

- Individualized flexible options for covering ones needs

- Young drivers with good records will pay less premium than average price elsewhere.

Cons:

- Service at their customer Centre could be uneven depending on where you are located

- Some users complain about increased cost beyond initial reduced premium period

Additional Suppliers.

There are other firms other than the major insurers that offer competitive prices and valuable car policies for young drivers. Such businesses as Esurance, Nationwide, and Farmers Insurance also have options that are created specifically for the new drivers. Furthermore, these providers may sometimes have unique discounts or coverages which might work better for some people.

Tips for Young Drivers to Secure Affordable Insurance

To get an affordable insurance policy for young drivers, do the following:

1. Maintain a Clean Driving Record

Avoid accidents and traffic tickets so that your driving record remains clear. Consequently, you will be eligible for reduced premiums and different kinds of discounts.

2. Take Advantage of Discounts

Check with the insurance company if it provides any discount such as good student discount, safe driver discount or low mileage discounts because they can save a considerable amount off your total insurance costs.

3. Consider a Higher Deductible

A higher deductible can mean lower premium rates but make sure you can pay out-of-pocket expenses in case of claim being filed against you on your motor vehicle policy by another party involved in an accident caused by you.

4. Drive a Safe and Reliable Vehicle

Opt for cars with good safety records and lower repair costs, which will help in reducing your insurance premiums and overall expenses.

5. Enroll in Defensive Driving Courses

Many insurers offer discounts for completing defensive driving courses, which can also help you become a safer driver.

6. Compare Multiple Insurance Quotes

Find multiple insurance quotes through comparison tools and resources to help you get the best rates and coverage options available.

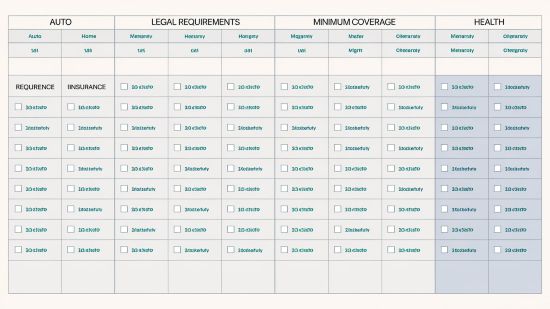

Legal Requirements and Minimum Coverage

Each state has its own legal requirements for car insurance coverage that it is important to know so as to follow the law without any penalties. Normally, minimum coverage requirements are:

- Liability Insurance: It pays for damages to others or injuries caused by an accident that you are responsible for.

- Uninsured/Underinsured Motorist Coverage: This one protects you if you have an accident with someone who is not adequately insured.

- Personal Injury Protection (PIP): It covers medical expenses incurred by both yourself and passengers in case of an accident.

Make sure you consult your state’s regulations to ascertain that your cover is enough.

Comparison Tools and Resources

- Online Comparisons: For example, Compare.com or The Zebra allows you to obtain quotes from multiple companies.

- Insurance Brokers: They offer individual advice and help in getting the best insurance options available.

- Insurance Company Websites: Most companies have online quote tools and other resources to help you in analyzing their policies.

Prospects of Auto Insurance

The automobile insurance trade is changing with upcoming technologies such as trends which may impact on premium costs, coverage choices etc.:

1. Usage based Insurance (UBI)

Usage-based insurance programs are those that use telematics to monitor driving habits so as to provide personalized rates using actual driving behavior. It works well for good drivers because it results into reduced premiums.

2. Telematics and Connected Vehicles

Advancements in telematics and connected vehicle technology, however, enable insurers to gather even more data on driving styles and car conditions which can be employed to customize the insurances.

3. Autonomous Vehicles

This could also have effects on insurance rates and coverage requirements as autonomous vehicles continue to rise. The advent of self-driving cars may force insurers to change their policies so that they can deal with new risks and liabilities.

Conclusion

While balancing affordability with adequate coverage is necessary when selecting auto insurance plans for young drivers, several alternatives exist for them. Young drivers can acquire a policy that caters for their needs while keeping their costs low by understanding what factors determine insurance premiums, shopping around different carriers, as well as applying discounts available. Whether you are looking for affordable rates on young driver’s cover or more extensive policies, it pays to compare providers, analyze your personal needs and make an informed choice that provides the best value and protection.