Subsidizing health insurance premiums is important because it allows individuals and couples to afford better healthcare. We will examine such questions as How Do Health Insurance Subsidies Work, how many categories do they have. How is the application process for them considering one would want to qualify for such and what are the health insurance premiums after factoring in these subsidies. Whether you wish to know about subsidies under the Affordable Care Act (ACA) or Covered California or any other programs available, you will find that information contained herein. For more detailed information, visit HealthCare.gov.

What are Health Insurance Subsidies?

Health insurance subsidies are meant to bring the health insurance costs within the reach of the people and families. By lessening the degree of out-of-pocket spending, they bring health services within reach of everyone. First of all, the low-income subsidy (LIS) can easily be defined as an insurance subsidy that aims to assist those especially with low income in having health coverage. For many low-income households, the health insurance premium credits again come from highly collapsing programs offered by the cities or states’ governments.

The meaning of health insurance subsidy may change depending on the program, nonetheless it usually implies some assistance in paying for health insurance premiums and other related costs, especially for the low income population.

Forms of Health Insurance Subsidies

There are primarily two types of health insurance subsidies available: premium tax credits and cost-sharing reductions. Therefore, a keen evaluation of these types of health insurance subsidies will enable one to establish which ones they are likely to qualify for.

Tax Credits As A Premium Subsidy

The premium tax credits Act is intended to assist you better health plan by decreasing the amount charge of monthly health premiums. Such credits are offered in regard to your income in the household. Understanding how premiums are calculated it is as well critical to understand how premium tax credits work.

Regarding insurance, it is utilized after insurance against health is purchased, a premium tax credit is available. However, for assessing qualification, certain factors seem to hinder and they are penalty tax credits.

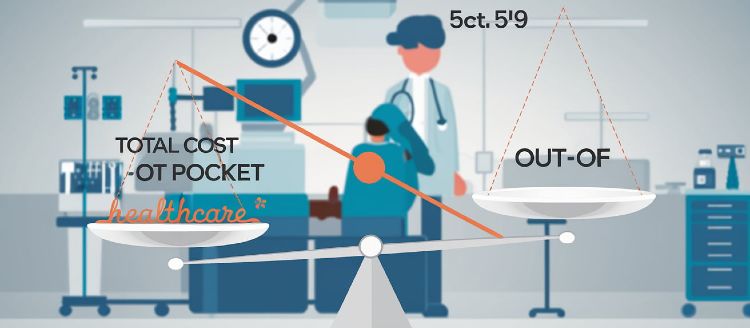

Cost Sharing Reductions

Cost-sharing reductions assist in cutting your expenses not limited to copayments, coinsurance, and deductibles. These reductions are available only for health insurance plans bought using the Health Insurance Marketplace. This article gives an account on cost-sharing benefits explaining how they help in making it easy to access healthcare services by lowering the cost incurred at the time of service.

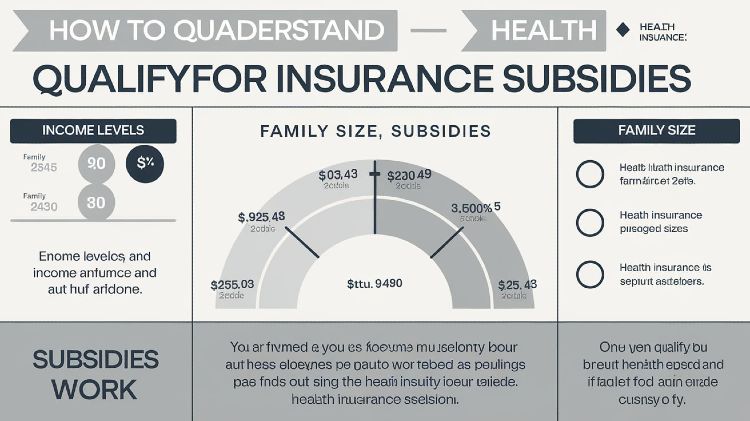

How to Qualify for Health Insurance Subsidies

The criteria for qualifying for health insurance subsidies is pegged on certain factors. Here’s a summary of how you can assess your qualifications:

Eligibility for Health Insurance Subsidies

In order to qualify for health insurance subsidies, there are specific income levels with respect to the federal poverty level within which one must be in order to qualify. There are limits set in relation to household size and geographical location that define the level of income one should have to access health insurance subsidies on an annual basis.

How to Apply for Health Insurance Subsidies

There are multiple procedures involved in applying for these subsidies. An application must be filled out through the Health Insurance Marketplace or state’s marketplace where one is located for example Covered California and the like. The procedure of applying for health insurance subsidies may seem fairly easy but in reality is very cumbersome due to the need for accurate income and household information.

What Is The Working Of Premium Tax Credits?

The premium tax credits attached to affordability of health insurance are very important. Let’s take a closer break down into premium tax credits:

Premium Tax Credit Eligibility

Eligibility for these credits is based on your income and family size. In most cases if your income is between 100% and 400% of the federal poverty level, you may qualify for premium tax credits.

Premium Tax Credit Calculator

You can also use a premium tax credit calculator before actually filling out the premium tax credit application to have an idea of the amount of subsidy you are going to request. This tool calculates your income and family size to give you the basic trust that it aids you to in the calculation of making a decision regarding your health insurance policies.

Premium Tax Credit Calculator

How Cost Sharing Reductions Work To Reduce Out of Pocket Costs

Cost sharing reductions are designed in such a way that your out of pocket costs are rationed thus improving more access to health care.

Lower Out-of-Pocket Costs with Subsidies

These reductions can be a great help to the patient by bringing down the cost of medical services including prescription medications. While seeking medical care these reductions help to cheapen the costs that you will have to incur.

How to Apply for Cost-Sharing Reductions

These types of reductions in the cost-sharing amount can only be made by those individuals who are enrolled in a health insurance plan that is obtained through the Health Insurance Marketplace. Once you are done registering, the reductions will be made automatically towards your costs that you incur outside of the assigned costs that are placed within the rages of the solve out which is done by the center which designed the computer program.

Applying for the Health Insurance Subsidies

One of the most important parts of the process is when you need to complete the application for the health insurance subsidy. Below is how to go about this process:

How to apply for the heath Insurance Subsidies

Application for Government health insurance subsidies can be made through the use of the internet and access the health insurance marketplace or that of your state. Double check that all the given income and household size is correct so that all the health insurance subsidies are up to the right amount.

Apply for Health Insurance Subsidies Online

Most of the marketplaces do have online application procedures more so most of the current population is making their application from where ever they are and not necessarily at the market place. This procedure usually involved registration, log in from the already existing accounts and filling sections of the application, and presenting additional forms as required.

Subsidies and Monthly Health Insurance Costs

Health insurance is very important in making a patient be able to meet health care costs. However, many countries have opted to offer certain subsidies and even pay monthly health insurance costs.

Health Insurance Subsidies and Tax Implications

Other than helping with healthcare costs, health insurance subsidies will influence your tax.

Tax Effects of Health Insurance Subsidies

Subsidy of health insurance may qualify you for other tax exemptions when you are filing your tax returns. Do health insurance subsidies expect you to include them in your taxes? Yes, that is so. Subsidies, for example, are in the form of advanced payments of the premium tax credit which gets settled against your income at year-end.

Tax Filing with Health Insurance Subsidies

While claiming taxes, it is important to ensure every subsidy has been claimed. This is very important to be able to obtain the correct financial help and to prevent complications while declaring tax.

Health Insurance Subsidies Common Myths

There are so many misconceptions that many people have towards health insurance subsidies. Let's debunk a few common myths about health insurance subsidies:

Health Insurance Subsidies Misconceptions

The first misconception that arises is that it usually comes from low-income people. In fact, for many of the programs available, subsidies are meant for a whole range of incomes depending on the program and your socioeconomic status.

Facts About Health Insurance Subsidies

The most important or, rather, the most common and general ways of health insurance subsidies are appropriate facts associated with it as these facts are quite easy and simple in nature and clear the confusions related to health insurance of the individuals seeking availment of financial assistance.

Changes to Health Insurance Subsidies in 2024

As time passes, a lot of variations are made in the field of health insurance subsidies.

2024 Health Insurance Subsidies Changes

Within the purview of 2024 health insurance subsidies changes, modifications extend to the income limits as well as the eligibility requirements. Changes do occur within policies and as such, gaining information on any of these changes will help you know how the new policies will affect you within the context of your health insurance coverage.

New Health Insurance Subsidy Rules 2024

New health insurance subsidy rules 2024 should change the ways in which these subsidisation structures are provided and include new strategies for the reimbursement of the health care services. Adapting to such changes enables an individual to manage appropriately their health insurance within the constraints set.

Latest Updates on Health Insurance Subsidies 2024

For the latest updates on health insurance subsidies 2024, check official resources or the Health Insurance Marketplace website. These updates provide crucial information on any new developments or changes.

Pros and Cons of Health Insurance Subsidies

[wptb id=977]

FAQs

How do Covered California subsidies work?

Covered California provides subsidies to lower health insurance premiums and out of pocket costs for residents of California. These subsidies are based on income and family size.

How do healthcare subsidies work?

Healthcare subsidies, including those under the ACA, reduce the cost of health insurance by providing financial assistance based on your income and household size.

How do ACA subsidies work?

ACA subsidies, or premium tax credits, lower monthly premiums for health insurance plans purchased through the Health Insurance Marketplace. Eligibility depends on income and household size.

How do Affordable Care Act subsidies work?

Affordable Care Act subsidies help make health insurance more affordable by reducing premiums and out of pocket costs for eligible individuals based on income.

How do healthcare gov subsidies work?

Healthcare.gov provides subsidies to reduce the cost of health insurance for eligible individuals. These subsidies are based on income and are available through the Health Insurance Marketplace.

How do insurance subsidies work?

Insurance subsidies reduce the cost of health insurance premiums and out of pocket expenses. They are determined by your income and household size and can be applied for through the Health Insurance Marketplace.

How do Obamacare subsidies work?

Obamacare subsidies also known as premium tax credits, lower the cost of health insurance premiums. They are available to individuals based on income and are applied through the Health Insurance Marketplace.

How do health insurance subsidies work?

Health insurance subsidies lower the cost of premiums and out of pocket costs for eligible individuals. They are calculated based on income and household size, making healthcare more affordable.