Purchasing a home is one of the most important decisions that any person makes in his or her lifetime, and therefore insurance on it is of utmost importance. Homeowners insurance is meant to protect them against many risks including natural calamities, robbery or even accidents. However, figuring out the costs that come along with having a classical homeowners insurance can be a headache. For this reason, a homeowners insurance calculator comes in very handy.

If you’re interested in understanding more about the options available, you may want to explore our article on the Best and Worst Homeowners Insurance Companies to get a comprehensive overview of the top providers and the ones you might want to avoid.

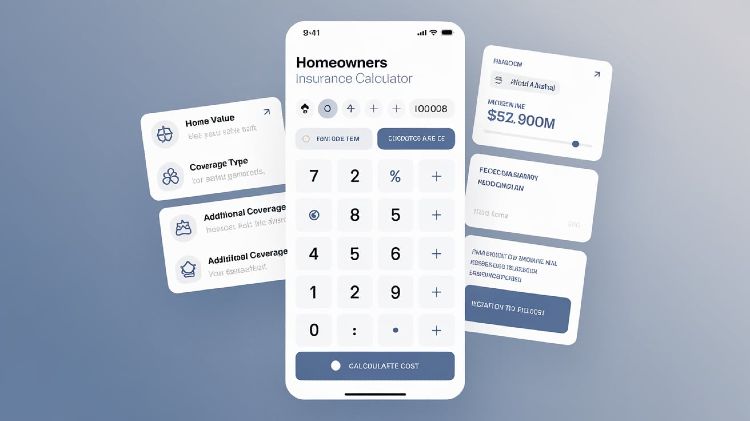

What is a Homeowners Insurance Calculator?

Based on the definition only, it is a simple method used for reviewing the cost of evaluating the home insurance policy. Factors like the area of the home, location, building materials etc and the level of coverage that the user wishes to obtain are factored. By entering all these details, the calculator gives an approximate amount for the premium which can help in educating the homeowners in planning their budgets and getting the right insurance.

Homeowners Insurance Calculator

Why Use a Home Insurance Premium Calculator?

There are many advantages of using a home insurance premium calculator:

- Accurate Estimates: This tool enables you to obtain a near specific period for the home insurance premium likely to be charged per month or annually.

- Cost Comparison: It enables you to consider in detail more than one insurance plan, and pick out the cheapest one.

- Coverage Customization: It helps in finding out the right limit of insurance required by you without being under insured or paying more premium for the insurance for which you do not require an extent of coverage.

How to Use a Homeowners Insurance Cost Calculator?

A homeowners insurance cost calculator is a device that often requests the input of the following:

- Home Value and Replacement Cost: You will put in the present market price of your house and the approximate cost of building a new house such as yours. This assists the calculator in working out the coverage needed.

- Location: You require the location of the house, because the vicinity has bearing factors such as weather conditions, crime rates and closeness to fire stations which can influence the premiums.

- Construction Details: Put in the materials your house is made of, age of the house and if the house has been remodeled.

- Coverage Options: Indicate the types of coverage available such as dwelling coverage, personal property coverage, liability coverage and additional living expenses coverage.

- Deductibles: Indicate how much your deductibles are, the idea being that the higher they are the lower the premiums.

Once all these details have been provided, the home insurance quotations calculator will give you an estimated monthly or annual premium.

Factors Affecting Homeowners Insurance Costs

The insurance cost to homeowners is subject to several variables. Look at these core components:

- Location of the Home: The location is very critical in determining the cost. For example, houses near the coast which are often hit by hurricanes or near earthquake zones may attract high premiums.

- Age and Condition of the Home: Older homes or homes in bad conditions could also be more costly to insure since they are more likely to suffer a loss.

- Coverage Levels: The more all inclusive the cover, the more expensive is the premium.

- Deductibles: A lower deductible will push the premium higher while a higher deductible will bring down the premium.

- Home Security Features: Discounts are often available on homes with security systems, fire alarms, and other protective devices.

- Claims History: Insurance premiums may be higher due to the frequency of claims made in the past.

- Credit Score: In some parts of the world, credit score has been used by insurers to determine premiums with higher credit score resulting in lower rates.

Types of Home Insurance Calculators

One type of home insurance calculator can be said to be dedicated to a certain type of work:

- Homeowners Insurance Quote Calculator: It is web based and enables one to make comparison of different rates and coverage from various insurance companies.

- Home Insurance Rate Calculator: more centered on the assessment of your ratio towards the offered insurance rate.

- Home Value Insurance Calculator: Today is used when one estimates the coverage needed to protect a particular home based on investment value or loss of property.

- Web Based Home Insurance Calculator: This is a free tool that can easily be done through the use of the internet and is quick in giving estimates.

- Home Insurance Measurement Keller: Helps one to choose the most optimal size of the deductible covering the insurance policy in case of loss according to the level of wealth and risk taker.

- Insurance Rate Comparison for Homeowners: This calculates how much you can save on your homeowner insurance by estimating discount options, such as multi-policy discounts or home security systems.

How to Calculate Home Insurance Coverage?

In order to calculate home insurance coverage promptly, you have to analyze the following:

- Replacement Cost: The cost of rebuilding the home from scratch using the current prices of materials and labor.

- Personal Property Coverage: The coverage of the building structure does not include the perils cover of items that belong to the owner of the house.

- Liability Coverage: Finances set aside to cover expenses that a homeowner might incur due to claims against them by visitors to their premises.

- Additional Living Expenses: Costs incurred if you need to live elsewhere while your home is being repaired.

By using a house insurance estimator, you can ensure you have sufficient coverage in all these areas.

Pros and Cons of Using a Homeowners Insurance Calculator

[wptb id=1004]

Calculators for Homeowners Insurance: Questions You May Have

What is a Homeowners Insurance Cost Calculator I can find on the web?

This is an insurance cost estimation tool that estimates your insurance premium depending on the home value, its location, the type of construction and the type of coverage you are after.

Home Insurance Premium Calculators how reliable are they?

Home insurance premium calculators usually give a rough figure as provided by the various calculators. The final charge may vary due to other variables such as your credit rating, specific savings provided by the insurance company, and so forth.

Does a House Insurance Estimator help in saving money?

Yes. A house insurance estimator assists in determining the available discounts that can be utilized such as combining car and home insurance, installing alarms and or fire sprinklers a home etc.

Home Insurance Rate Calculator and Homeowners Insurance Quote Calculator – explain the difference in these terms.

home insurance rate calculator assists in understanding how heavy insurance costs will be, while homeowners insurance quote calculator helps to find the best price ranging among different providers.

Can I fill out an Online Home Insurance Calculator for more than one property?

Sure, most of the online home insurance cost calculators allow you to feed in the details of many properties thereby determining more than one cost coverage options.

What are the guiding principles in operating a Homeowners Insurance Deductible Calculator?

When effectively using homeowners insurance deductible calculator think about how much you will pay as a deductible amount if a claim were to arise. Low premiums may be obtained through high deductibles, they will however need to be settled.

As it appears, it takes a Home Insurance Savings Calculator, what exactly does it do and how is it helpful to me?

This calculator identifies numerous areas that someone may be able to save money on insurance costs such as by bundling policies, adding security measures to a home or being free of any liability claim. This may go a long way in helping cut down the total expenditure on insurance.

Tips for Using a Homeowners Insurance Calculator

- Collect Pertinent Data: Make certain that all important information are available such as how much your house is worth now, what it is made out of and what protective features it has.

- Examine Multiple Estimates: A homeowners insurance quote comparison tool to help you request estimates of different insurers.

- Consider Coverage Types: Know what each type of coverage provides and what is the right amount.

Know what deductibles can be helpful, Given a valid reason, select the deductible that would suit both the premium costs and your finances.

Conclusion

A home owners insurance calculator assists almost anyone in estimating the likely costs for home insurance coverage they are going to incur in order to find the best options available in the market. With this sort of knowledge, together with various premium calculators, it is possible to keep expenses on premiums lower than before. Home insurance is a complicated subject, be it for a first-time buyer, or a long-term homeowner. These tools can help with the searching process in order to get the right home insurance cover.

For further information, check out Allstate’s Homeowners Insurance Calculator or visit Progressive’s Insurance Estimator.

As insurance premium calculator, house insurance, house insurance coverage estimator, online home insurance calculator you will understand your needs, find affordable options, and get your house fully protected by insurance policies. One important tip is that you need to check your policy for changes and update it when necessary so as to support renovations or improvements in the value of your home or change in lifestyle activities that warrant the coverage.