As a new driver, one of the challenges is getting ideas on where to get car insurance considering that even the most basic plans seem to be costly to inexperienced drivers. However, there are ways to find cheap car insurance for new drivers. I am going to address the issue of how to obtain low-cost car insurance for new drivers, specifically teenagers and young adults, and describe the companies providing the best rates.

While Gap insurance can be beneficial for new drivers especially those looking for cheap car insurance for new drivers it doesn’t cover every situation. Gap insurance will not pay if your car’s damage doesn’t result in a total loss such as in cases of minor accidents.

Why Is Car Insurance Expensive for New Drivers?

Insurance companies all over the world consider novice drivers as high risk too. A teenage driver, a young man aged less than 25 years or an adult late on the road who obtained a license is a risk. Things such as lack of seat belt usage or alcohol drinking lead to more accidents by the inexperience behind the wheel. Which is why, young driver insurance, especially car insurance for under 25 drivers, is the most expensive. But with the right approach, it is still possible to take good new drivers insurance at a reasonable rate.

Factors Affecting Car Insurance Rates for New Drivers

There are a number of reasons which lead to great expense in regards, to car insurance for the new drivers which include the following:

- Age and Experience: Those in their teens and people below 25 years are usually charged high rates but there are ways in which cheap car insurance for teenagers and reasonable rates after 30 years of age can be found.

- Location: Your current place of residence dictates your rates quite a lot. Drivers in urban cities are able to pay higher rates owing to the higher accidents rates than that of charges in rural setups.

- Vehicle Type: Insurance companies take into account the year, make and model of the clients vehicle in a way that impacts their insurance coverage. In most instances, vehicles with good ratings as far as safety features are concerned and also low cost in repairs carry lower insurance policies.

- Driving Record: Even though you belong to the category of new drivers, when you have had any accidents, or legal violations this might attract higher than expected premium. On the other hand, all categories of new drivers are considered and even the honorable ones with no accidents will get low rates.

How to Find Cheap Car Insurance for New Drivers

- Compare Quotes Online: If you are new into driving, and you are looking for the cheaper meant for new drivers, one of the best means is to compare the quotes online. There are several companies possessing comparison tools so that people can help them look for automobile insurance policies among newly drivers and the cheapest car insurance policies to drivers below 25 years or teenage drivers.

- Search For Discounts: Discount policies are offered to clients by most insurance firms to cut the costs. Check for safe driver, good student (parents with students), and driver’s education course discounts. This is important in searching the cheapest car insurance for teens where possibilities of getting such discounts are quite beneficial.

- Select A Higher Deductible: The higher the deductible the lower the monthly payment. Though this means that you will incur a higher expense when involving yourself in an accident, it is a good strategy for keeping the premiums down especially in persons looking for very cheap insurance for teens or young adults.

- Make The Most Of Bundle Insurance Policies: For instance, if you have home or renter’s insurance policies, find out whether you can combine them with your car insurance. Most of the companies will offer you great discounts when bundling making it possible to find affordable car insurance for new drivers.

- Think About Pay As You Drive Insurance: For instance, usage based or pay as you drive insurance possibilities can be very beneficial for novice drivers. These policies monitor your driving behavior and if you qualify under certain behavior you could get rated lower than actual.

Pros and Cons of Cheap Car Insurance for New Drivers

[wptb id=956]

Best Coverage Options for New Drivers

Try to maintain a tune between the cost of the coverage and its protection against risks. As a novice driver, you are likely to be persuaded to take out a minimum coverage; nevertheless, you should be slow in making this decision.

Liability Coverage

Liability insurance is usually the least amount of coverage you can purchase but provides the least amount of coverage. It provides compensation for loss resulting from damages to other people’s cars and harm to other licensed drivers but not to one’s own car.

Collision and Comprehensive Coverage

Even though these policies cost more, the protection they afford after an accident or a robbery is worth the extra costs. Cheap new driver insurance after 30 years can combine both extents of coverage at rates lower than younger drivers.

Uninsured Motorist Coverage

This policy provides protection where other people you are driving against are not insured. This is a useful cover to consider for individuals taking cheap auto insurance for the first time drivers where this option does not significantly increase the premium.

[wptb id=957]

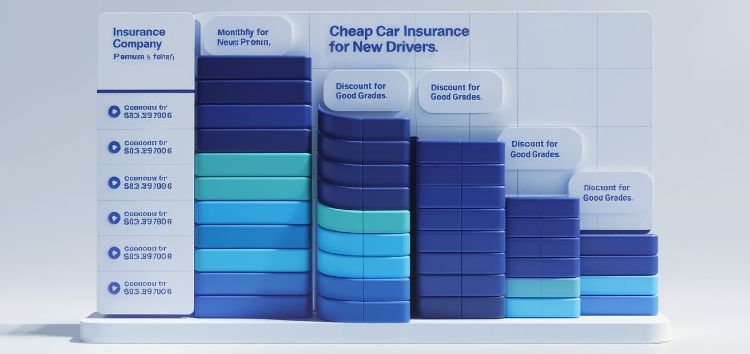

Reviews of the Best Car Insurance Companies for New Drivers

1. Geico

Offers complete services both online and offline. The young adult population often compliments Geico as among the providers offering some of the safest car insurance for teenagers and reasonable prices for newer drivers.

2. State Farm

Many of the reviews highlight the presence of attractive discounts for student drivers and drivers aged 25 years and below on State Farm policies. This company is typically noted to have good customer service standards when it comes to its products.

3. Progressive

With respect to Progressive auto insurance policies, customers express satisfaction with the company’s pay-as-you-drive insurance. It is a repeated recommendation especially for cheap car insurance for teenagers and budget car insurance for young adults over 30 years.

4. Allstate

Highly supportive of their policies, Allstate provides one of the best teenage driver insurance policies with respect to adjustable plans. Most of the under 25-year-old drivers cite the ease in working with the insurance company’s versatile options.

Frequently Asked Questions (FAQs)

What is the best way to get cheap car insurance for new drivers?

Comparing several different auto insurance companies’ quotes is the fastest way to get cheap car insurance for new drivers, request discounts, and also look into usage based insurance models. Furthermore, combining policies will greatly help to lower expenses.

Can teens find cheap car insurance?

Yes, although insurance for teens is generally more expensive, a number of such companies have substantial discounts which makes it cheaper. Look for good student discounts, safe driver programs and comparison shopping to get such rates.

What is the cheapest car insurance for drivers under 25 years?

Geico, State Farm and Progressive are some companies that provide some of the cheapest car insurance for under 25 drivers. Lower rates can be found by embracing high deductibles or risk based insurance schemes.

What about new drivers over 30, can they get reasonable car insurance?

Yes Of Course. Although new drivers over the age of thirty may still be required to pay more on premiums than their more experienced counterparts, their insurance premiums in general tend to be less than those for teenage or young adults. Obtaining quotes and looking for high-risk driver insurance in Texas at a cheap rate will be easier for new drivers over 30.

Does my car affect how much my insurance cost?

Yes, there is a considerable influence on the make and the model of your vehicle on the amount of money that you spend for insurance. Premiums for cars with good safety features and low cost of repairs are also lower making it possible to have cheap car insurance for new drivers.

How can I lower the rate of car insurance because I am a young driver?

To lower your premium costs as a young driver, you can try to take a driver’s education course, keep a clean driving history, opt for a more expensive deductible, and look for insurance rebates.

Is the insurance cost lower for male or female drivers?

In Europe and the US, due to statistical data regarding driving, the insurance influence for male young drivers is often more than that of female young drivers. No doubt these trends are changing fast as more and more players in this space are moving towards meritocratic pricing rather than gender stereotyping.

Which companies provide cheap car insurance prices for drivers under 25 years old?

Geico, and Progressive and State Farm are firms which target on providing insurance cover for the less than 25 year old drivers at low rates. These companies offer many such discounts which work towards decreasing the rate for young adults and youths.

Would usage-based insurance make sense for a new driver?

Yes, usage-based insurance is usually a good option for new drivers since it monitors an individuals’ driving pattern. This provides an incentive to safe drivers, which is why this is useful for people who have cars and wish to obtain low-cost car insurance.

How can I stay away from high premiums as a teenager and still drive?

Teenage drivers can escape the steep fees by signing up for safe driving courses, getting a good GPA for discounts, and driving cars that bear less risk.

Conclusion

Although it may seem impossible to come across numerous affordable car insurance for new drivers, there are various approaches that are geared toward reducing premiums. Young drivers and those under the age of 18 can benefit from cheap car insurance, be it through comparing quotes on the internet or using beneficial offers. Car insurance for teenagers or cheap car insurance for newly drivers over 30 is attainable from companies like Geico, Progressive, State Farm, Allstate, and the likes who have viable packages. Always bear in mind the examination of your particular needs, habits of driving, and what different companies offer for you to make good savings.