Cheapest Life Insurance For Seniors Over 70 is a hard nut to crack. In fact among different policies available, one has to know their choices in order to get the most reasonable coverage. This thorough guide will take you through the cheapest life insurance for seniors aged over seventy years, policy types that do not require a medical exam, differences in coverage with unique policies and so forth.

Why Life Insurance Is Important For Elderly Over 70

With aging, comes a change in demand of the people’s demand for their financial planning requirements. Life insurance becomes a planned provision which helps with the end of life expenditures and providing a cushion for one’s family. Here’s why it is critical:

- Final Expenses: It pays for the costs of burial and other funeral expenses which can be expensive.

- Loan Settlements: Assists in clearing any loans so that the family does not suffer because of it.

- Gifting: It gives monetary gifts such as inheritance to the beneficiaries.

Types of Life Insurance for Seniors

Term Life Insurance

Term life insurance offers coverage for a limited amount of time, within the range of 10 to 30 years. For seniors looking for a limited coverage, this type of policy could be a cheaper option. It also helps to mention that term life insurance for seniors over 70 offers lower premiums compared to whole life insurance which makes it a affordable option for many.

Whole Life Insurance

Similarly, whole life insurance coverage remains until death and provides an additional benefit of cash value. Whole life insurance comes with its disadvantages since it is expensive, but it provides the insured rights while the policy is active and when it expires, it also provides cash value.

Guaranteed Issue Life Insurance

Seniors who wish to obtain guaranteed issue life insurance do not have to cross the hoops of medical screening or assessing their health conditions as this type of insurance is a pure guarantee to any senior irrespective of their health condition. This policy does not require appraisal or health assessment and thus is easy to get but is often expensive.

Simplified Issue Life Insurance

Overall, simplified issue life insurance is the type of insurance that requires answering some quiz-like health questionnaires and you won’t be examined physically, or medically. Most of the time, this is also a cheaper option for older people who do not have major health concerns.

How to Find the Cheapest Life Insurance for Seniors Over 70

There are ways in which you can minimize your search for the cheapest insurance policy for seniors over the age of 70 years.

1. Compare Quotes

First things first in the case of quoting life insurance policies it is advisable that comparison of quotation from more than one provider is necessary to totally eliminate redundant policy expenses. There are online tools as well as insurance comparison websites where this work can be made easier.

2. Consider No Medical Exam Policies

Life insurance policies where one does not have to go through a medical exam and has no waiting period policies may provide a suitable or realistic option for the elderly that require insurance in a simple and swift manner. State Farm and other suppliers are known to Best life insurance for seniors no medical exam requirements.

3. Assess Coverage Amounts

Identify the coverage amount that will be enough depending upon the financial requirements of your household. For instance, $250k life insurance no exam policy might be fitted to those people who are responsible for big money matters as to household.

4. Think About Plans Exclusive To Their Age

Some insurance companies provide the best and of all cheap life insurance for seniors over 80 or age 70 plus plans. This is because there is a great advantage of low premiums and special terms for the elderly.

Look for the Most Uncomplicated Solutions

Cheapest Life Insurance Over 50 No Medical Exam

When looking for policies that provide cheapest life insurance over 50 no medical exam, it is important to note that there are many insurers who offer these types of products which usually do not require much underwriting. This kind of life insurance policy is made especially for the elderly citizens who are usually averse to taking thorough medical exams.

Cheapest Life Insurance for Seniors Over 80

Finding the cheapest life insurance for seniors over 80 is definitely not a child’s play. Nonetheless there are some insurances that do provide cheap life insurance for seniors, making it possible for even the oldest of the applicants to be covered with reasonable premiums.

Regional Considerations

Life Insurance for Seniors Over 60 No Medical Exam California

Seniors in over sixty life insurance no medical examination California provide cover that caters to the regional regulations to the residents of the state of California.

Features to Consider:

- State Regulations: Confirm that the policy adheres to the California regulations on insurance coverage.

- Local Providers: Select companies operating within California since they will have better offers and rates for services.

Government Life Insurance for Seniors

Life insurance for seniors plans offer some affordable options but are usually government directed with some conditions placed on ages of those who are able to get it.

Government Programs:

- Social Security Survivors Benefits: Extended to the rest of family members who were left behind by the deceased.

- Veterans’ Benefits: Life insurance coverage and other associated benefits for eligible veterans and their dependents.

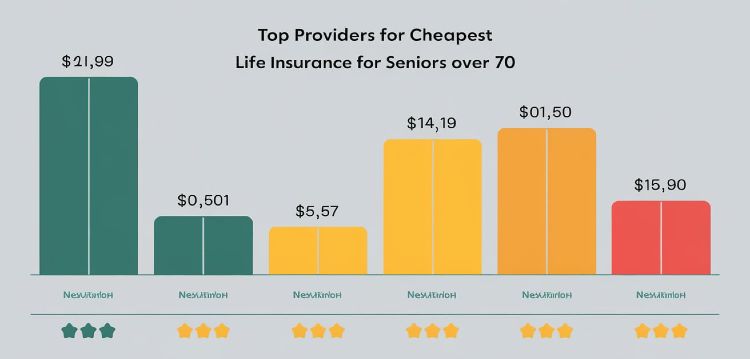

Top Providers for Cheapest Life Insurance for Seniors Over 70

Here’s a detailed look at some of the top providers that offer Best life insurance for seniors over 70:

State Farm Life Insurance

State Farm is an insurance company that is well recognized in its circle and as such offers many options for the older people. Their term life insurance is worth mentioning especially for more than 70 year old individuals who are looking for not-so-expensive policies within that age bracket.

- Pros: State Farm has very flexible policies with varying terms and benefits. Their service quality is also impressive.

- Cons: The application process can be more complicated with some policies requiring a medical examination.

AIG (American International Group)

What does Life insurance for seniors between the ages of 55 AIG? AIG provides a number of term and whole life insurance policies to seniors with flexible options.

- Pros: AIG has life insurance of $500k no medical application, a lifetime worth it for persons who need higher insurance coverage. There is mostly no period to wait with the policies.

- Cons: If one is looking for bigger levels of coverage, the premiums can be rather exorbitant for other providers.

Mutual of Omaha

The Mutual of Omaha insurance company specializes on cheap policies for seniors who want to buy life insurance. Their policies suit clients who are likely to have health problems.

- Pros: They offer the cheapest insurance for seniors above 70 years, and have an across-the-board less no medical insurance policy time with no medical issues. Their burial policies are extremely cheap.

- Cons: Coverage amounts may be limited compared to other providers.

Gerber Life Insurance

Gerber Life is also a great option, especially with regards to their final expense insurance Naches.

- Pros: It is the cheapest life insurance over 50 with no medical exam. The application process is simple so much so that even illiterates can understand it.

- Cons: Insurance cover limits are set relatively lower than normal and although satisfying to some people, they may be inadequate for others.

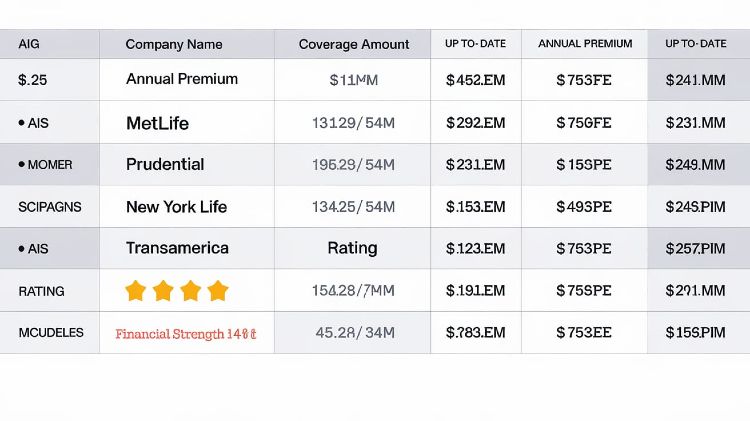

Summary Table of Life Insurance Options

[wptb id=885]

Tips for Selecting the Best Policy

Policies of insurance providers can be numerous, and such a choosing this or that is not as easy due to all these choices. But in every situation comes a solution and impressively there are ways to select the best option for you. Below are some tips on how to choose the best insurance policy accurately:

1.Assess Your Needs

- Identify Coverage Requirements: Define exposure that has to be covered, be it health, auto or property insurance, life insurance or other types. Think in such terms as your health, property, children or current spouse.

- Evaluate Risks: Consider estimating some risks and liabilities which exist. For example, it would be prudent to purchase flood insurance if you live in an area that is susceptible to floods.

2. Understand Different Types of Policies

- Types of insurance policies: Know the different types of policies available. In health insurance, you will hear about HMOs, PPOs, HDHPs associated with managed care. For auto insurance, the knowledge of liability coverage, collision coverage, and comprehensive coverage is beneficial.

- Policy variations: Even within these categories, there may be differences in policies. Problems might arise if these modifications are not studied comprehensively, which will result in being underinsured or overburdened with unnecessary costs.

3. Compare Multiple Quotes

- Obtaining Multiple Quotes: There are several options for this type of coverage so get a few different insurance quotes to compare coverage breadth and cost. Make sure to compare similar types of coverage with the same limits.

- Use Comparison Tools: Make use of online comparison tools or get in touch with insurance brokers for the same so that you can more easily cover all the options available.

4. Understanding the Reputation of the Insurer

- Research Financial Stability: Examine the insurance firm’s financial strength by Google rating A.M. Best, Moody’s, or Standard & Poor’s Agencies. Stably situated insurance firms tend to pay out claims more reliably.

- Read Customer Reviews: Search for customer reviews to know how satisfied people are with the company when there is a request for a claim as well as services offered.

5. Get to Know the Terms and Conditions of the Policy

- Read the Fine Print: It is important to pay great attention on the policy documents especially the scope of coverage, what is and what is not covered, their exclusions, what the deductibles will be as well as any limits that will be put on the policy. Knowing things like these will assist in making sure that there are no surprises when it is time to file for claims.

- Clarify Ambiguities: In case any of the terms or conditions may be met with questions on what they really mean, then it is prudent for one to contact the insurance provider. This is crucial because some things are covered and others are not.

6. View the Discounts and Benefits

- Find out about discounts: At this point, do not forget to ask whether there are discounts available for bundling policies (for example home plus auto), loyalty reward programs, or discounts for driving safely.

- Additional Benefits: About stated benefits, look for other additional benefits such as roadside assistance, wellness programs or protection from identity theft which will add more value to your policy.

7. Consider Premiums and Deductibles

- Premium Costs: Know if the premium is affordable. Note that low premiums come on the effect of higher deductibles or lesser coverage.

- Understandable: Deductibles and copayments help to prepare for the costs which require out of pocket to be incurred. Make sure you can work out how painful the deductible amount will be when combined with the premium amount.

8. Review the Claims Process

- Claims Efficiency: Check how convenient it is to file a claim with the specific insurer. Claiming is made easy with a quick and simple procedure especially when in urgent need.

- Support and Assistance: Investigate the support provided through the process of a claim, including the possibility of customer service and providing assistance as needed.

9. Look for Flexibility and Customization

- Customizable Options: Some policies may provide some flexibility as far the provision is concerned. See if the limits of the coverage can be changed and if added coverage can be included to help you meet your specific purpose.

- Policy Changes: Confirm the willingness of the insurer to make some additions to the policy as time progresses and your circumstances change.

10. Consult with an Insurance Advisor

- Professional Guidance: If you’re unclear about making a right choice, it is recommended that you retain an insurance advisor or broker. You might get more helpful advice relative to your personal situation as OIt can be a complicated process to figure out which policy options are best for you.

11. Revisit Policy Each Year for Review

- Endorsements or policy modification: Policies should be reviewed on regular intervals or updated if the original stipulations no longer meet the policyholder’s dreams or situation. Marriage, family and relocation may all be reasons for making any changes to one’s coverage.

12. Assess Compliance Requirements

State Regulations: Make certain that the insurance policy is not violating any states’ laws or other state specific requirements. This is very important in regards to compulsory cover such as vehicle covers.

Real-Life Experiences

Case Study: Affordable Coverage For Jane

At 72 years old, Jane was worried about the implications of taking out a life insurance policy but still wanted to provide for her family financially. After comparison shopping, she made the decision to purchase a policy through Mutual of Omaha. The no medical exam policy let her avail of cheap policies without a long coverage period. Jane found it easy and convenient because of the sense of security it assured her.

Case Study: Tom’s High Coverage Needs

Tom, actually 75, also needed more coverage so as to cover his estate taxes. He selected an AIG policy with no medical exam offering a life coverage of 500k. Despite the high premiums, Tom felt that the coverage felt apposite and the absence of any requirement for a medical exam was an edge considering his health status.

FAQs About Life Insurance for Seniors Over 70

What is the best life insurance for seniors over 70?

It is best life insurance for senior over 70 years of age will depend on the person and health condition. Options include term life insurance, whole life insurance, and no medical exam policies.

Can I get life insurance with no medical exam if I’m over 70?

Best Life insurance for seniors over 70 no medical exam is also possible. There are policies that do not require going through any medical tests as their primary objective.

How can I find the cheapest life insurance for seniors over 70?

To get the lowest affordable policy for seniors 70 years and above, you will have to get as many quotations as possible including looking at policies that do not require medical exams and the amount of coverage.

Is there government life insurance for seniors?

Yes, it’s possible that government life insurance for elderly persons may be obtainable through some programs which aim to provide the best rates and coverage as well.

What are the benefits of term life insurance for seniors over 70?

Senior term life insurance above 70 also presents with lesser premiums and is said to be short-term coverage which acts as an alternative to senior citizens where a cover is needed for a specified time frame only.

Conclusion

It is not easy to find the cheapest life insurance for people who are older than 70 years and this is because most people have to ponder upon their requirements, health and expenses. Ensuring that every option is the cheapest including guaranteed issue life insurance and no medical exam policies, as well as seeking quotes from many providers will enable you to acquire a policy that will be able to afford all of your needs. There are good policies for seniors from such providers as State Farm, Mutual of Omaha, and AIG, thus enabling you to have the required cover at an affordable cost.